ASB: Financial Checkup

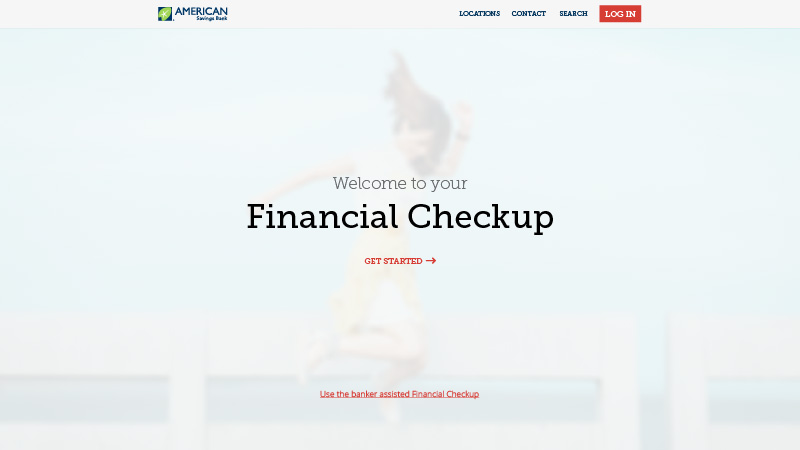

While working at Revacomm, we worked closely with American Savings Back (ASB) to support several marketing initiatives. Prior to this project they had worked with a separate company to generate a catalog of resources but didn’t have a way to curate the content to the customers needs. This project was created to solve that problem and we were tasked with designing and building a simple an easy process that would ask number of questions and provide a set of results for the customer.

To create as simple a tool as possible I turned to a very familiar model, Turbo Tax. Using this existing model helped both our team and the team at ASB to refine the questions and process to minimize drop-off throughout the process.

When designing the financial checkup we were asked to include two different paths: one for customers and one for bank employees to walk through with customers. Rather than build separate tools, we built a single tool with a slight modification that would allow bank employees to tie results to the customers account available by selecting the secondary link at the bottom of the page.

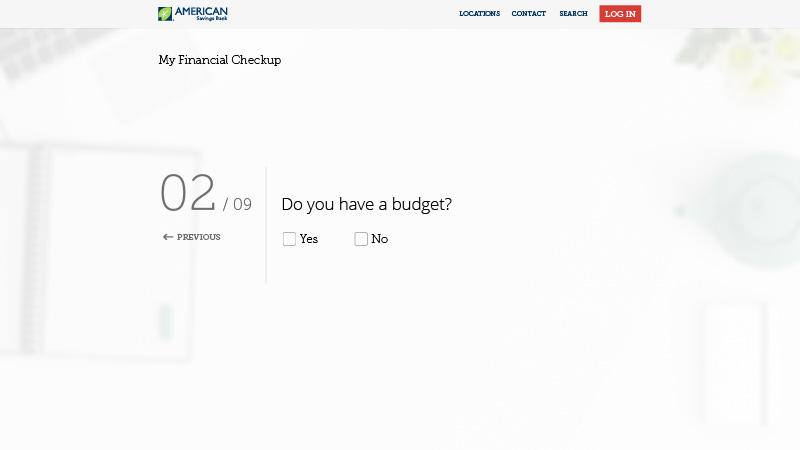

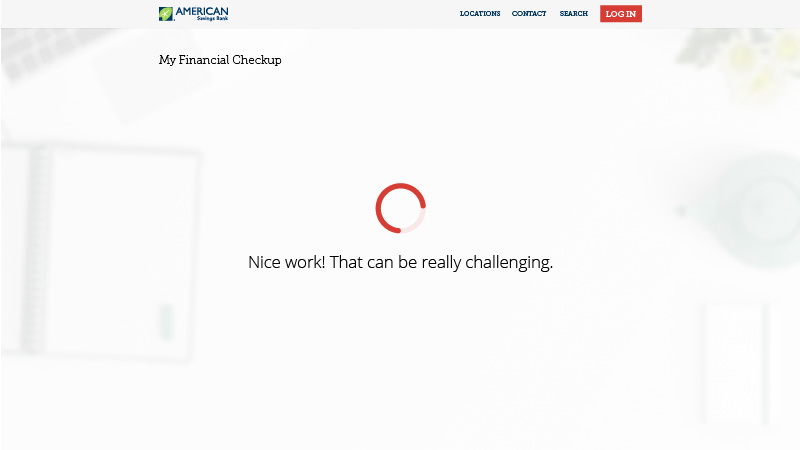

Each question was optimized to be as quick and simple to answer as possible. On selection, the user was moved to a confirmation providing supportive feedback.

Depending on the question and answer selected, the user would be provided different confirmations but the messaging provided was always positive, either affirming or reassuring the user.

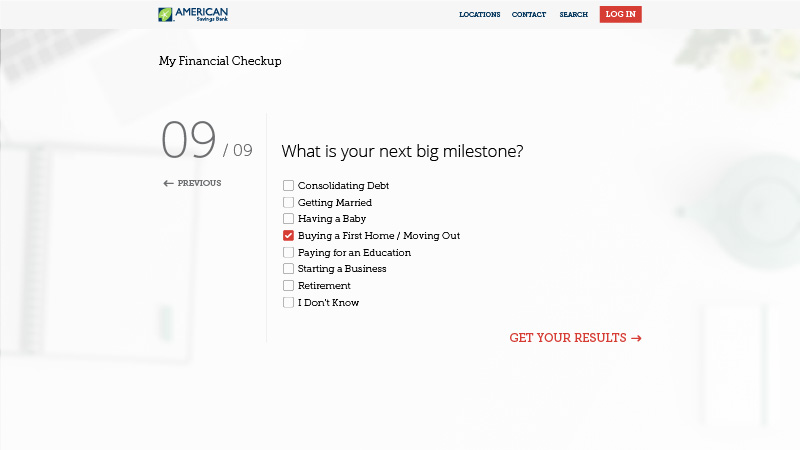

While the rest of the questions help to assess the financial wellbeing of the customer, the final question provides the necessary context to show the most relevant curated content available for the user and assists ASB employees to tailor their service to the customers goals.

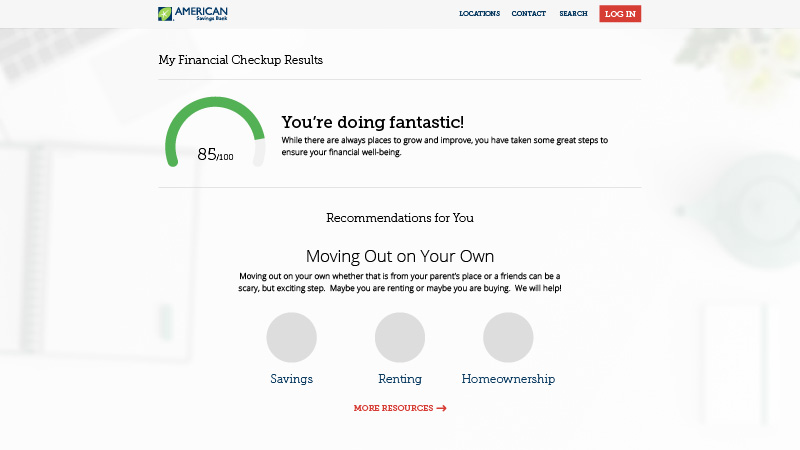

Once all questions are complete, the results of the checkup are displayed along with the most relevant resource articles from ASB’s catalog. If the internal version was selected, this screen has an addition field for a customer ID. Once saved, the results are attached to the customers profile for follow-up.

Additional Thoughts

While not a very complex project the financial checkup it was rewarding to optimize what was at first a very complex process. It was very well received by the team at American Savings Bank and they have continued to use it and make improvements such as adding a ‘make an appointment’ feature.